Hong Kong Gold Rush Weekly: forum highlights uncertain Sino-US future, CE's APEC trip, trade pact with Peru, Tencent profit jump, economic slowdown

A 5-minute read for your next opportunity in the Asian financial hub

Hi, this is Yifan in Hong Kong. Here’s what you need to know about this week’s business and investment opportunities in the Asian hub.

Business signals:

US-China Hong Kong Forum reveals the arduous task of bridging misunderstandings

HK’s charm offensive at APEC

Closer trade ties with Peru

Market pulses:

The stock market closed at 19,426.34 points, down 4.11% last week

HK-listed tech giant Tencent posted a 47% profit jump

Fundamentals:

Full-year growth forecast revised to 2.5%

Business signals:

#US-China Hong Kong Forum reveals the arduous task of bridging misunderstandings

Dignitaries and business pundits from the world’s two largest economies gathered in Hong Kong on Friday to work on what could be an impossible task of bridging deep-seated Sino-US misunderstandings amid growing political fragmentation.

Craig Allen, president of the US-China Business Council, said that the two countries are deeply entangled economically, and pulling that apart would be very difficult and costly. “But that doesn't mean that politics will lead us in that direction,” Allen told the Hong Kong US-China Forum, which was packed with international envoys, politicians, and pundits.

Titled “Reflection and Forecast”, the two-day event is the first major international forum on bilateral relations following the US presidential election, in which Donald Trump clinched a commanding victory over Kamala Harris.

Chinese official data showed that total trade between China and the US surpasses US$660 billion, with over 70,000 American companies operating in China, generating US$50 billion in annual profits. Regarding employment, exports to China alone support 930,000 jobs in the United States.

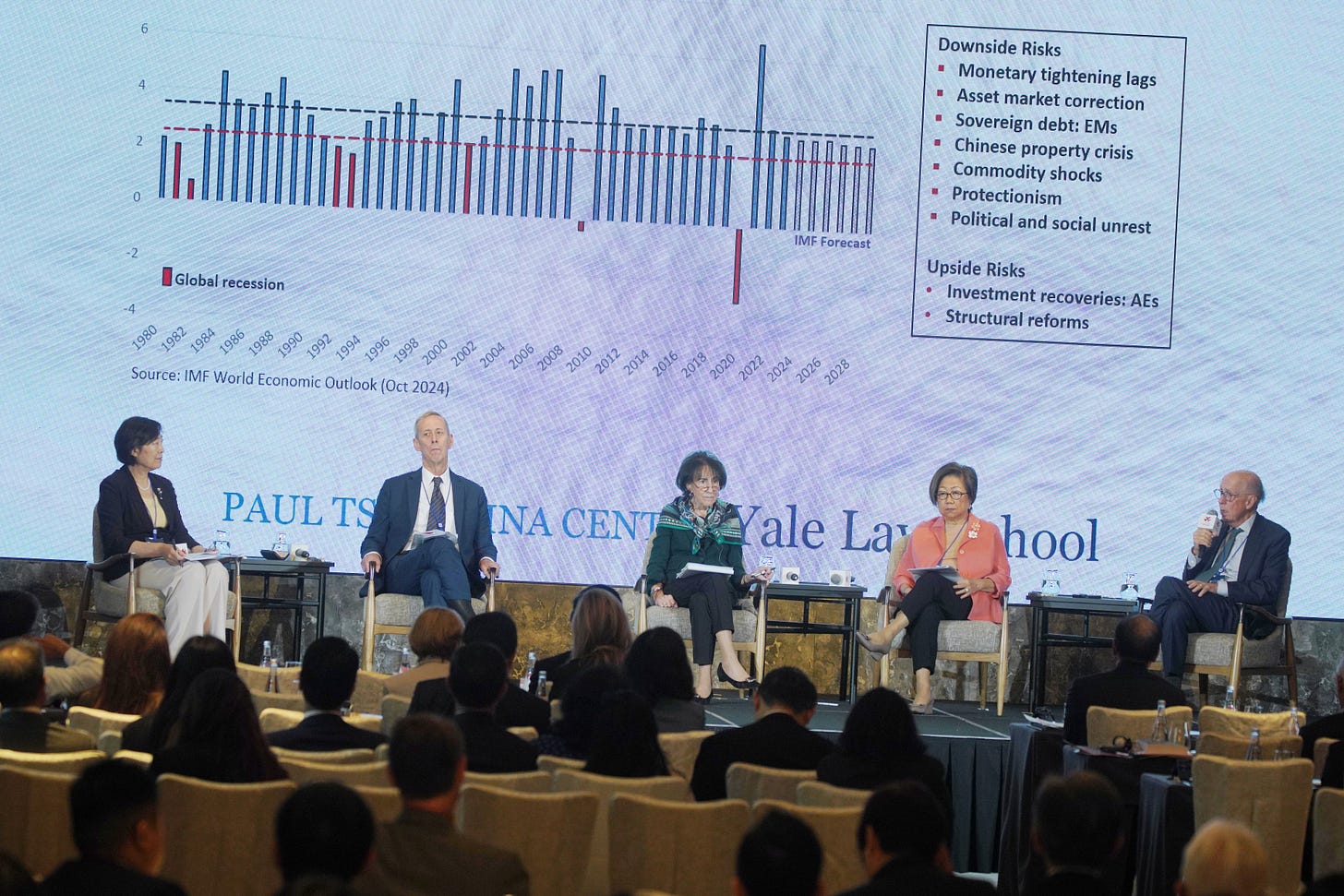

However, the possibility of increased protectionism driven by the president-elect is cited as a “great risk” by senior fellow of Yale Law School, Stephen Roach, who stirred discussions this year with his Financial Times opinion piece titled “It pains me to say Hong Kong is over”.

As part of Trump’s “America First” nationalist agenda, the billionaire Republican promised to raise tariffs on all imports coming into the United States from zero to between 10 to 20% and to boost those on Chinese products to 60%.

Problems associated with that policy change would trigger retaliatory responses from all of the US trading partners including China and elsewhere in Asia, Europe, South America, and the rest of the world, said Roach, who formerly chaired Morgan Stanley Asia. According to the International Monetary Fund’s calculations, that could lower global growth starting in 2025 by 0.5 to 0.75%.

The former US president’s stunning comeback and the plans he laid out in campaigns were default ice-breakers for network conversations outside the forum’s speech house at the St. Regis Hotel, where buffet tables were set up in its foyer to dish out dim sums and other delicacies.

During his first term as US president, Trump raised tariffs on China from 3% in 2018 to 19% where they stand today. A lot of discussions in the morning suggested that he might not be serious enough to press ahead, but Roach gave a heads-up that China and the rest of the world have to take Trump more literally this time.

Evidence for this can be seen in the China hawk team he has assembled around him, including Florida senator Marco Rubio as his choice for secretary of state.

This is further underscored by a growing sense of bilateralism in US politics, an inclination to blame China for the US’ woes, and a willingness to “put politics over economics” in the ratcheting up of protectionism, Roach added.

During the opening ceremony, Xie Feng, China’s ambassador to the United States, highlighted the need for the two nations to strengthen dialogue and communication.

“The two sides need to let dialogue and win-win results define our interactions, not confrontation or zero-sum mentality. We need to enhance dialogue at various levels and in various fields, eliminating misunderstanding and miscalculation, expand common interests and foster closer ties between our two peoples, so as to inject fresh impetus into China-U.S. relations.

China is always open to dialogue. We welcome more exchanges between our peoples, and we are willing to be partners and friends of the United States. We hope the U.S. side will also move with us in the same direction. The two sides need to properly manage differences. Time has changed. Past tragedies of major country conflict should not be allowed to repeat. It is important to ensure the giant ship of the China-US relationship will not lose direction or speed, still less having a collision.”

Some efforts have largely succeeded: the two nations have resumed military-to-military communications and established various working groups on commercial, economic, financial and agricultural issues.

However, the headwinds between the two superpowers are expected to remain strong, according to US Ambassador to China Nicholas Burns, who pointed to a slew of critical differences that must be addressed in his video speech.

“Despite decades of reform and opening, the PRC still discriminates against American businesses and investors. We want to see progress on intellectual property and an end to forced technology transfers, unfair subsidies and other measures that tilt the playing field against American companies in China. We are deeply concerned with the after effects of the Counter-Espionage Law, the amended State Secrets Law, and other recent measures. These efforts to effectively criminalize corporate due diligence and the sharing of routine economic data increase risk, and they undermine China's investment climate.

Burns also touched on other sensitive issues including human rights in Xinjiang and differences in electoral systems.

An attendee said on the condition of anonymity that the event seemed like drew more crowds than last year and was impressed with how straight the US ambassador was. “But, you know, opinions vary based on standpoints,” he added.

#HK’s charm offensive at APEC

Hong Kong Chief Executive John Lee Ka-chiu attended the 31st APEC Economic Leaders' Meeting to discuss trade, investment for inclusive growth, innovation, and digitalization for global economic transition, and sustainable growth for resilience with leaders of other economies.

This year, APEC's theme is "Empower. Include. Grow." During the APEC Economic Leaders' Meeting Retreat on November 16 (Lima time), Lee emphasized that innovation and digitalization are crucial for driving prosperity and inclusive growth.

Highlighting Hong Kong's proactive use of innovation and technology to enhance productive forces, Lee stated that efforts and resources are focused on boosting new industrialization, advancing AI development, encouraging cross-disciplinary R&D, and integrating real and digital economies.

Regarding sustainability, the city’s leader mentioned that Hong Kong launched the Hydrogen Development Strategy in June to capitalize on hydrogen energy opportunities and facilitate capital matching with quality green projects, promoting green economic transformation. He expressed his hope to collaborate with APEC member economies to advance regional economic integration and development.

During Lee’s week-long visit to Lima, Peru, he met Malaysian Prime Minister Anwar Ibrahim for the first time since July last year and also had two more bilateral meetings with Vietnamese President Luong Cuong and Singaporean Prime Minister Lawrence Wong.

#HK and Peru sign free trade pact

Hong Kong and Peru signed a free trade agreement (FTA) on the sidelines of the Asia-Pacific Economic Cooperation Economic Leaders’ Meeting in Lima, Peru, on November 15.

The Free Trade Agreement between Hong Kong, China and Peru, which will take effect in about six months or so, covers an extensive array of liberalization and facilitation commitments that go far beyond those undertaken by the World Trade Organization.

Under the FTA, Hong Kong service providers can enjoy benefits in over 150 service sectors where Peru has made specific commitments. These commitments encompass sectors where Hong Kong has traditional strengths or has potential for development, including professional services, computer and related services, research and development services, financial services, and transport services.

For trade in goods, Peru committed to eliminate tariffs on approximately 98.3% of its tariff lines for Hong Kong’s originating goods exported to Peru, among which tariff elimination concerning 91.3% of the tariff lines would take immediate effect upon the entry into force of the FTA, while tariffs of the remaining 7% tariff lines would be phased out gradually.

CE John Lee said at the signing ceremony:

“It offers significant strategic value to both economies. Peru, with its young and energetic population of more than 34 million, is an emerging market of enormous potential. It's also a participating economy in China's Belt and Road Initiative.

The merchandise trade between Hong Kong and Peru grew 4% a year, on average, between 2019 and 2023. Our services trade expanded 16% a year between 2018 and 2022.”

Market pulses

Benchmark Hang Seng Index (HSI) retreated 4.11% last week, closing at 19,426.34 points on Friday.

#HK-listed tech giant Tencent posted a 47% profit jump

China’s most valuable company Tencent on Wednesday reported a profit surge in the three months ended September, driven by growth in games, advertising, and cloud services.

The Shenzhen-based company’s profit soared by 47% year-on-year to 53.2 billion yuan (US$7.36 billion) in the third quarter. Revenue rose by 8% to 167.19 billion yuan.

Management anticipates that Tencent will generate "significant" free cash flow next year, which could be used for dividends and share buybacks.

Ivan Su, senior equity analyst at Morningstar, said wide-moat Tencent’s third-quarter earnings are in line with expectations. “Overall, we maintain our HK$704 (US$90.4) per share fair value estimate and continue to view shares as deeply undervalued, trading at about a 40% discount to our valuation.”

Read more on Chinese tech giants’ earnings-https://www.chinadailyhk.com/hk/article/590699#Chinese-tech-giants%E2%80%99-bitter-sweet-earnings-paint-a-bumpy-recovery-picture-2024-08-15

Fundamentals

#HK revised full-year growth forecast to 2.5%

Hong Kong revised growth expectations to 2.5%, the lowest end of its previous forecast range of 2.5% - 3.5%.

The downgrade followed data on the same day showing Hong Kong’s GDP expanded by 1.8% in the third quarter from a year earlier. That compared with growth of 3.2% in the second quarter and 2.8% in the first quarter of 2024.

Government economist Adolph Leung said in a statement:

“Taking into account the actual outturn in the first three quarters of the year and the latest developments of the global and local situation, the real GDP growth forecast for 2024 as a whole is revised to 2.5%, from 2.5%-3.5% in the August round of review. The Government will continue to closely monitor the situation.”

Looking ahead, while the external environment has turned more challenging recently, the Hong Kong economy is expected to maintain its growth momentum for the remainder of the year, said Leung.

“Increased global economic uncertainties and escalation of trade conflicts would affect the performance of our goods exports. Nonetheless, the expected further monetary easing by major central banks, together with the mainland's recent introduction of various measures to stimulate the economy, would help support sentiment and activities in our domestic market. Specifically, gradually easing financial conditions should bode well for fixed asset investment.

The central government's various measures benefitting Hong Kong, the SAR government's various initiatives to boost market sentiment, as well as better sentiment in the asset markets and increasing employment earnings would be conducive to spending by both residents and visitors in the domestic market, though the change in their consumption patterns will continue to pose a constraint.”

Superb!😊